|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

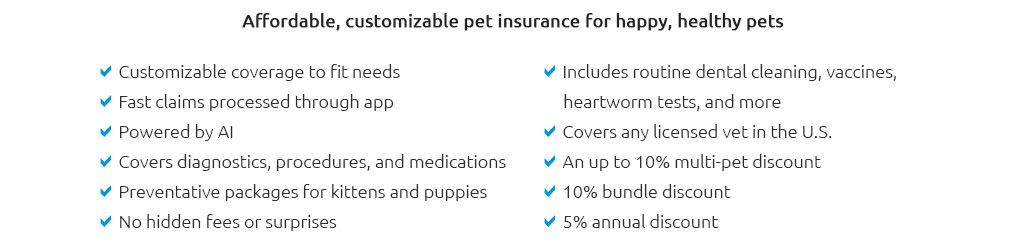

Understanding Pet Insurance for Pre-Existing ConditionsIn the ever-evolving world of pet care, one topic that often sparks significant debate is pet insurance for pre-existing conditions. This concept, although not entirely new, has gained momentum as more pet owners seek comprehensive coverage for their furry companions. The primary question lingering in many minds is whether obtaining insurance for a pet with a pre-existing condition is feasible and, if so, how effective it truly is. Before delving deeper, it's crucial to understand what constitutes a pre-existing condition in the context of pet insurance. Simply put, a pre-existing condition refers to any illness or injury that your pet has been diagnosed with or has shown symptoms of before the start of a new insurance policy. Insurers often scrutinize veterinary records to determine these conditions, which can sometimes lead to disputes between pet owners and insurance companies. Historically, many insurance providers have been reluctant to cover pre-existing conditions due to the financial risks involved. However, a growing number of companies are beginning to offer more flexible plans. This shift is largely driven by consumer demand and the recognition that pets, like humans, deserve a chance at affordable healthcare regardless of their past health issues. For pet owners, navigating the insurance landscape can be daunting. It requires thorough research and an understanding of the specific terms and conditions laid out by each insurer. Some companies offer 'curable' pre-existing condition coverage, which means that if a condition has been cured and symptom-free for a specified period (usually 12 months), it might be covered. However, chronic conditions like diabetes or arthritis often remain excluded. When exploring options, pet owners should consider several factors. First, the cost of premiums is a major consideration. Policies covering pre-existing conditions tend to be more expensive, but they might offer peace of mind in the long run. Additionally, understanding what constitutes a pre-existing condition under a specific policy is vital. This includes being aware of any exclusions or waiting periods that could affect coverage.

In conclusion, while securing pet insurance for pre-existing conditions may present challenges, it is not an impossible endeavor. The landscape is gradually shifting to accommodate the needs of pets with prior health issues, thanks to growing demand and advocacy for more inclusive insurance policies. Pet owners must arm themselves with information, ask the right questions, and make informed decisions to ensure their beloved companions receive the care they deserve. Ultimately, the goal is to provide a safety net that supports both pet health and owner peace of mind. https://www.trupanion.com/pet-insurance-faq/article/how-to-tell-pre-existing-conditions

Pet health insurance does not cover pre-existing conditions. To know what to expect with coverage, it's worth knowing how these conditions are detected. https://content.naic.org/article/consumer-insight-does-coronavirus-have-you-worried-about-pet-insurance-learn-most-current-facts-and-find-coverage

For pre-existing conditions considered curable, the company may choose to enforce a waiting period before coverage can begin. Conditions considered incurable ... https://www.nerdwallet.com/article/insurance/pet-insurance-pre-existing-conditions

Most pet insurance companies will not cover costs related to pre-existing conditions. A pre-existing condition refers to any illness or injury that occurred ...

|